𝗖𝗵𝗮𝗻𝗴𝗶𝗻𝗴 𝗧𝗶𝗱𝗲𝘀: 𝗜𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀 𝗚𝗿𝗮𝘃𝗶𝘁𝗮𝘁𝗲 𝗧𝗼𝘄𝗮𝗿𝗱 𝗘𝗺𝗲𝗿𝗴𝗶𝗻𝗴 𝗠𝗮𝗿𝗸𝗲𝘁𝘀

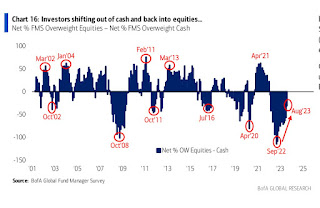

Bank of America's monthly Fund Manager Survey, which canvassed 247 panelists representing $635 billion in assets at the beginning of August gave some interesting insights into shifting institutional sentiment.

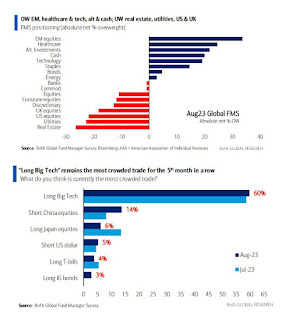

For the fifth month in a row, "Long Big Tech" was considered the most crowded trade and investors exhibited a stronger conviction toward cheaper assets, with net overweights in Emerging Markets flashing a decisively strong reading.

As it stands, EM's are trading at a discount of circa 50% versus their developed peers, and as the year unfolds, growth differentials in EM's are set to become pronounced on the back of their favorable demographics, robust manufacturing capabilities and superfluity of critical resources.