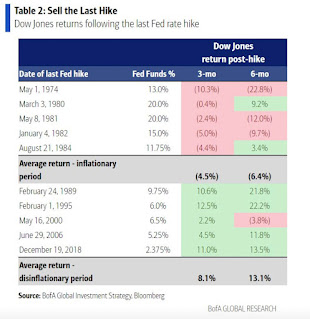

"Sell the last rate hike" strategy tends to work when monetary policy needs to work harder to slow economy in inflationary era (e.g. 1970s/1980s - Table 2); 5-year Treasury at 5% we think buy, meantime stagflationary barbell in stocks (long energy, long staples), or contrarian trades via long "hard landing" plays e.g. REITs, retail (XRT), banks (BKX) vs "no landing" plays Mag7, SOX, XHB, XLI, XBD; and own gold as hedge against nightmare of higher yields and lower US dollar on loss of credibility of US policy makers.