BofA : EM equity outflows past 2 weeks ($1.2bn). EM Debt outflows past 7 weeks ($1.1bn). Data dari Bank of America (BofA) capital outflow dari pasar saham dan surat utang emerging market.

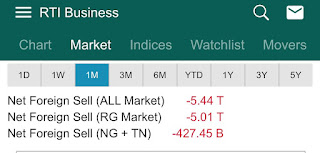

Asing sebulan terakhir keluar dari IHSG sebesar 5.44 triliun.

Report BofA dalam bentuk PDF lengkapnya sudah diupload di channel telegram Rikopedia tanggal 19 Sept 2023. Channel telegram Rikopedia klik di sini

Ringkasan report dari Bank of America (BofA)

In summary:

1. Asset Performance:

- Crypto and commodities have performed well, with gains of 33.3% and 8.4% YTD, respectively.

- Stocks have seen a 14.2% gain, while gold and government bonds have lagged.

- US dollar has gained 1.8%, while government bonds have seen a -2.2% YTD return.

2. US Exceptionalism: Americans tend to spend money when worried about the future, contrasting this behavior with Europeans and Asians who save money.

3. US Nominal GDP: Expected to jump by 6% in 2023, contributing $1.6 trillion to the $27 trillion economy.

4. Market Sentiment:

- Money market funds (MMFs) have seen significant inflows, indicating a lack of conviction in the market.

- Investors are showing confidence in a soft landing consensus, with significant inflows into bonds and stocks.

- Large-cap stocks and technology sectors have attracted substantial investments.

5. BofA Private Clients: Asset allocation for private clients includes 60% stocks, 21.3% bonds, and 11.9% cash. There are inflows into Japan, growth and value stocks, and bank loan and municipal ETFs, while TIPS, financials, low-volatility assets, and gold ETFs are being sold.

6. BofA Bull & Bear Indicator: The indicator has dropped to 3.6, driven by outflows from EM stocks and bonds and deteriorating global equity market breadth.

7. Three-Year Comparison (2020 to 2023):

- US nominal GDP has surged by 40% due to significant monetary and fiscal stimulus.

- Inflation has risen from 1% to 9%, and global yields have increased.

- Winners include crypto, commodities, and the Nasdaq, while banks, bonds, and China stocks have underperformed.

8. Long-Term Trends:

- Trends such as COVID-19, geopolitical conflicts, and climate goals have accelerated shifts in the global economy.

- These shifts are expected to result in an era of higher inflation, interest rates, and boom-bust market cycles.

9. Fiscal and Labor Trends:

- Despite a 40% surge in nominal GDP, the US deficit remains at 7-8% of GDP, leading to increased Treasury supply.

- Labor unions are demanding wage increases, which could lead to higher labor costs.

- Geopolitical factors, such as oil production cuts and low US inventories, are affecting oil prices.

10. Softer Policy for Longer:

- Central banks may adopt Yield Curve Control policies to manage debt.

- Higher inflation targets could be considered, potentially impacting monetary policy.

11. Higher = Harder:

- Rising indicators such as a steeper yield curve, higher default rates, and increased delinquencies suggest challenges ahead.

- Investors may rally initially but face risks if the economic situation deteriorates.