While investors often have short memories, there is substantial evidence pointing towards a possible repetition of this trend:

▪️Severe yield curve inversions

▪️The potential lagging effect of the steepest monetary tightening in decades

▪️The narrow leadership in the stock market

▪️A significant rise in the cost of debt

▪️Oil prices nearing $90 per barrel

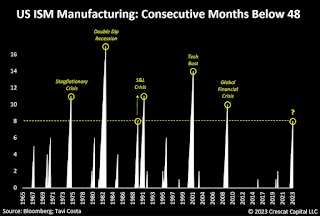

▪️Corporate fundamentals already contracting

In the meantime, financial markets remain excessively complacent, with credit spreads at historically low levels and exorbitantly high valuations in the overall stock market.